Newsletter_FINCITY.TOKYO UPDATE (OCTOBER 2025)

31 OCTOBER 2025Newsletters

Updates from Tokyo’s expanding finance and startup ecosystem and the 54 members of FinCity.Tokyo.

Introducing Our Directors

Interview: Tokyo’s Initiatives to Become a World-Leading Global Financial City

Hisashi Sekiguchi, Chief Program Officer for Global Financial City Promotion, discusses Tokyo’s wide-ranging activities to realize the city’s potential as a global financial hub.

Events Info

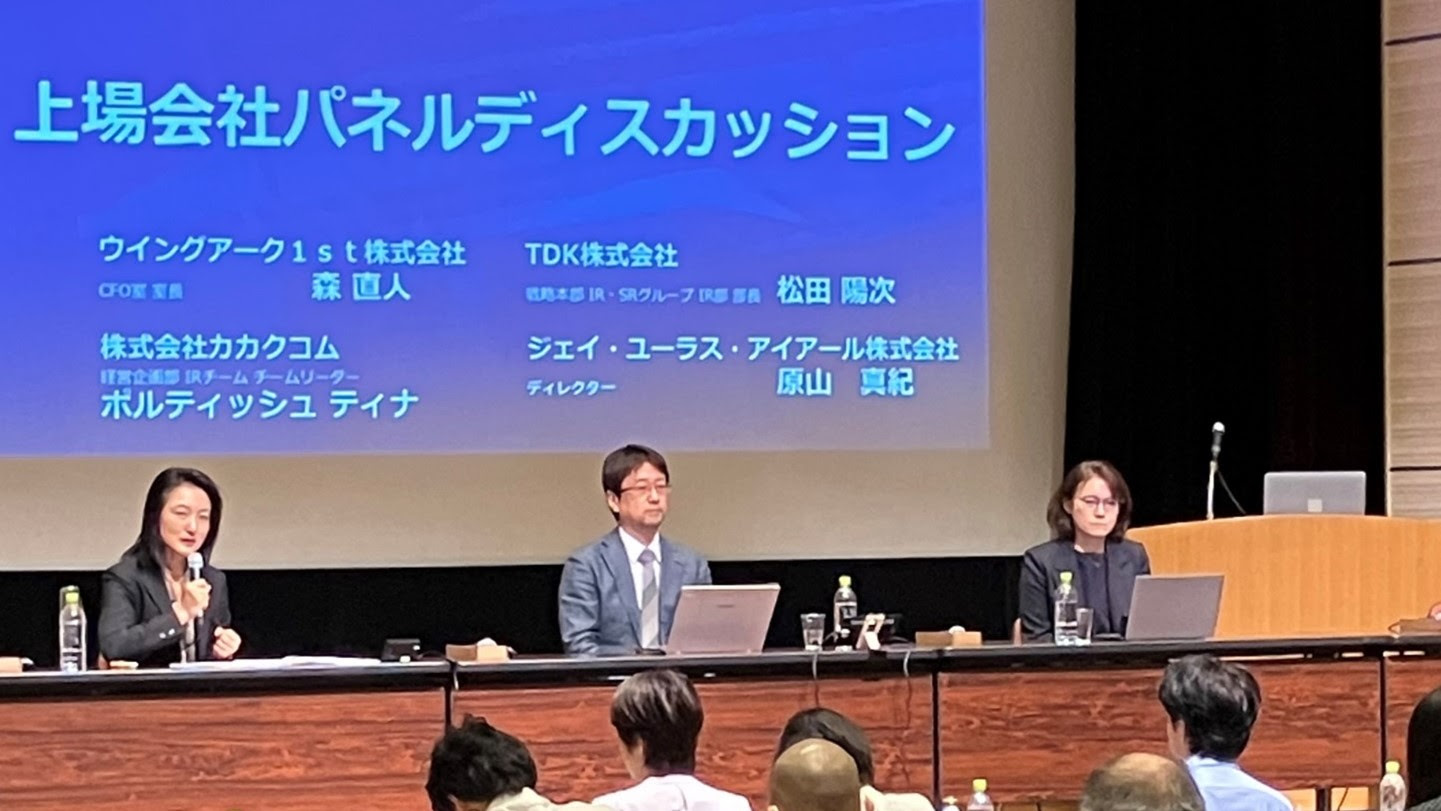

English-language IR human resource development course

On October 8-9 FinCity.Tokyo concluded its annual Disclosure G seminar on investor communication in English. Through lectures and workshops, participants learned what foreign investors look for and how to effectively formulate a compelling growth story.

FinCity.Tokyo meets with Paris Europlace

On October 8, a delegation from FinCity.Tokyo met with Mr Olivier Vigna, Deputy CEO of Paris Europlace, the financial services promotion organization for Paris, to discuss how our two financial centers can collaborate going forward. The discussions covered green finance, digital finance, infrastructure investment and competitiveness of financial centers.

6th TOKYO Sustainable Finance Week concluded

FinCity.Tokyo has concluded the 6th annual Sustainable Finance Week, dedicated to the advancement of sustainable finance. The event included programs for business professionals, as well as activities for individuals that are useful for daily life and asset building.

- Kicking off the week, the Tokyo Sustainable Finance Forum on October 15 gathered global leaders from government, finance, and industry to discuss the latest developments in sustainable finance. You can access the slides from FinCity.Tokyo Chairman Hiroshi Nakaso’s presentation here (in Japanese):

- On October 24, FinCity.Tokyo held its second seminar on sustainability management for SMEs. The session covered a variety of perspectives, including practical approaches learned from collaborations with large companies, how to utilize financial institution support programs, and strategies to promote women’s participation and strengthen organizational capabilities.

KEY STORIES IN JAPANESE MEDIA

- Nikkei Average Maintains 50,000, Private Estimate Says This Could Boost GDP by 0.9 Trillion Yen; Expectations of Increased Consumption (Nikkei, October 27)

On October 27, the Nikkei Stock Average surpassed 50,000 for the first time ever. According to an estimate by Takuya Hoshino at Dai-ichi Life Research Institute, if the Nikkei continues to hover around the 50,000 mark, there could be a roughly 0.16% positive effect on real GDP in 2026, equating to approximately 0.9 trillion yen. A higher stock market could improve household sentiment and potentially stimulate personal consumption.

- Prime Minister Takaichi Pledges “Strong Economy” Through Aggressive Fiscal Policy—Discipline Put to the Test (Nikkei, October 24)

In her policy speech on the 24th, Prime Minister Sanae Takaichi repeatedly mentioned the goal of a “strong economy,” but the concrete roadmap for achieving it remains to be outlined. With inflation causing growing pressure on social security expenses, steady reforms are crucial for sustainability. Enhancing defense capability in response to changing international circumstances will also be ineffective without secure funding. The challenge will be how to maintain discipline in “responsible” proactive fiscal policy.

KEY STORIES IN INTERNATIONAL MEDIA

- Nikkei average hits 50,000 for 1st time on US-China deal, likely Fed cut (Nikkei Asia, October 27)

Japan’s benchmark stock average topped the 50,000 mark for the first time on Monday as investors welcomed an easing in U.S.-China tensions and with expectations growing for the Federal Reserve to further cut rates this week.

- Deals for Startups Reach Record in Japan Before Listing Curbs (Bloomberg, October 20)

A plan to cull the smallest listings on the Tokyo Stock Exchange is spurring a record number of buyouts of young companies in Japan, reflecting Tokyo’s push to create more billion-dollar startups to better match the country’s global standing in scientific research.

- Why Japan’s Mom-and-Pop Investors Are Stepping Back Into the Market (Wall Street Journal, October 10)

Japanese savers are starting to invest again, breaking with a decadeslong habit thanks to a renewed government push to get households to put their money to work. A revamped government program has lowered key hurdles to investment, making it easier to build assets long-term.

Copyright © 2025 FinCity.Tokyo. Distributed for FinCity.Tokyo by Kreab K.K.