Interview:Hiroshi Nakaso, Chairman of FinCity.Tokyo for the December 2025 Newsletter

16 DECEMBER 2025Interviews

Interview:Hiroshi Nakaso, Chairman of FinCity.Tokyo for the December 2025 Newsletter

In this special interview, Hiroshi Nakaso, Chairman of FinCity.Tokyo, outlines where he sees Japan and Tokyo in the current global context and his vision for Tokyo as a financial hub.

Let’s start with the macro picture. How do you see Japan in the current global context?

To summarize into three words: Japan is back. After the painful lessons of the Lost Decades, we have a robust banking system, deflation is behind us, and global investors are enthusiastic. Amidst the global uncertainty arising from Trump 2.0 policies, Japan’s economy has demonstrated its resilience and capital keeps flowing into our country. I see this trend continuing for several reasons (also outlined in Chart 1):

• Trump 2.0 has driven some global investors to diversify their portfolios away from USD assets to other currencies including the yen.

• The move from savings to investments continues as Japan once again has positive interest rates.

• Stronger corporate governance spearheaded by the JPX requires corporate management to focus on capital costs and stock prices.

• Many M&As, including MBOs, are in the pipeline as firms realign business portfolios. As the JPX plans stricter continuation criteria for listed companies, we will likely see more M&As.

Chart 1:

That said, there is much left to do. The previous administration’s growth strategy remains incomplete and the Government’s Plan for Promoting Japan as a Leading Asset Management Center needs further traction. I feel reassured that our new Prime Minister, Sanae Takaichi, is placing these initiatives high on the agenda.

How do you view FinCity.Tokyo’s track record in building Tokyo’s position as a global financial hub?

Since launching in April 2019 under Governor Yuriko Koike’s initiative as Japan’s first public-private financial promotion body, we have grown from about 30 to 54 members. This spans the Tokyo Metropolitan Government, the Japan Exchange Group (JPX), major financial institutions, real estate companies, industry associations, banks, fintechs and universities. The fact that we have such a breadth of financial expertise sharing our vision is significant.

One of our key missions is to build a concentration of high-performing asset management firms and financial talent in Tokyo to create a new investment channel into Japan’s bank-centric economy. Here, our efforts are bearing fruit. Last year alone, FinCity.Tokyo attracted three asset management firms with AUM totaling over USD 161.3 billion and one credit rating agency, KBRA — the first new entry of a credit rating agency in roughly 15 years.

Can you share some key milestones?

I would like to highlight four:

• We contributed to a reform of Japan’s inheritance tax. Before the tax reform in 2021, an expat’s assets held outside Japan were taxed, which led many in the foreign business community to say they could “never die in Japan.” That part of the tax is now gone.

• We have been pushing to invite both domestic and overseas asset managers to play a more active role in elevating investment returns, especially so-called “emerging managers.” These are typically small, independent, and active managers with high investment skills but with short track records. They have so far been sidelined in Japan, where big asset management companies affiliated to parent banks and security houses are dominant. Our Emerging Asset Manager Promotion Program was incorporated into the Kishida administration’s Plan for Promoting Japan as a Leading Asset Management Center, which marks a major milestone for us.

• The importance of financial promotion is now widely understood. As our activities have expanded, we have attracted supporters from across Japan. For example, the Tokyo Sustainable Finance Week, which we organize annually in October, began as an independent event but is now part of the broader nationwide financial event — the Japan Weeks —led by the Financial Services Agency and hosted by various public and private sectors.

• Tokyo was designated an Asset Management Special Zone alongside Sapporo, Osaka, and Fukuoka. Our cities are working together to attract new domestic and international asset management firms, expand operations, draw global investment capital, and create an environment where funds are channeled to growth sectors.

How does Tokyo differ from other finance hubs in Asia and what path do you see for Tokyo in the future?

Tokyo’s role differs from other Asian centers. Hong Kong is as a gateway to mainland China. Singapore connects Asia with other regions. Tokyo’s defining characteristic is that it is an “onshore financial center” supported by Japan’s multi-layered industrial base with its extensive Asian supply chains. Therefore, Tokyo’s role is to meet the financing needs of various industries and contribute to the sustained growth of economies in the Asia-Pacific region.

In this context, a key mid-to long term strategy is to position Tokyo as a pioneer in sustainable finance in the Asia-Pacific, with focus on transition finance. As a hub of Asian supply chains and a global leader in greentech patents, we are uniquely positioned to leverage finance to fight climate change by promoting decarbonization. We can channel the resulting massive investment and technological innovation into sustained economic growth of not only Japan but across the region.

You mentioned transition finance. Can you elaborate on your vision for this?

In my childhood, a hot summer day meant 30°C. Today, that’s cool. Climate change is a threat to civilization itself. There is no time to waste. That is why the Japanese government is committed to becoming carbon-neutral by 2050.

But companies cannot go green overnight, especially not high-emitting industries like steel and shipping, so it makes sense to move in steps toward decarbonization without moving the 2050 target. There is a broad agreement in the Japanese business community and the manufacturing economies of the Asia-Pacific to incentivize not just “green” projects but also “amber” projects that enable a realistic transition to net-zero. This is where Tokyo can help promote a smooth transition in the region.

Carbon neutrality by 2050 will necessitate huge capital expenditure — as much as USD 960 billion (JPY 150 trillion) by Government estimates — into R&D and development of innovative technologies, such as new energy sources like hydrogen, and carbon capture, utilization, and storage (CCUS). Capital expenditure and innovation are two engines for elevating Japan’s growth, so decarbonization is an ideal strategy.

Public-private collaboration is key. For example, while our Government has committed to issuing JPY 20 trillion in Climate Transition Bonds, we must mobilize private capital far beyond that.

Therefore, in collaboration with authorities and private sector entities, we have been promoting the issuance of Transition Bonds, proposing new means of financial instrument including currency basket indexed bonds, blended finance with risk mitigation elements, and interoperable carbon credit instruments to be traded on a cross-border basis in the Asia Pacific. Our extensive network with authorities and market participants has been effective in advancing these ideas.

Looking ahead, what strategic direction do you see for FinCity.Tokyo?

I see the following strategic directions for us:

• We will of course support the Government’s Policy Plan for Promoting Japan as a Leading Asset Management Nation, which was recently reaffirmed by Prime Minister Takaichi.

• We will strengthen collaboration with regional financial institutions, including banks. These are well-connected to local businesses and firms, while FinCity.Tokyo grasps the needs of domestic and global investors who are eager to discover promising regional enterprises and projects. By working together, we can circulate growth capital into the regions.

• We will continue to accumulate and share knowledge as a sustainable finance pioneer. The issuance of Transition Bonds by Japanese companies now exceeds USD 8.9 billion, steadily accumulating expertise that Japan can offer other economies facing climate challenges. Meanwhile, the Tokyo Metropolitan Government continues to issue SDG-related bonds. In October 2024, it issued approx. €300 million in Sustainable Bonds. It also plans to issue some €300 million in Tokyo Resilience Bonds.

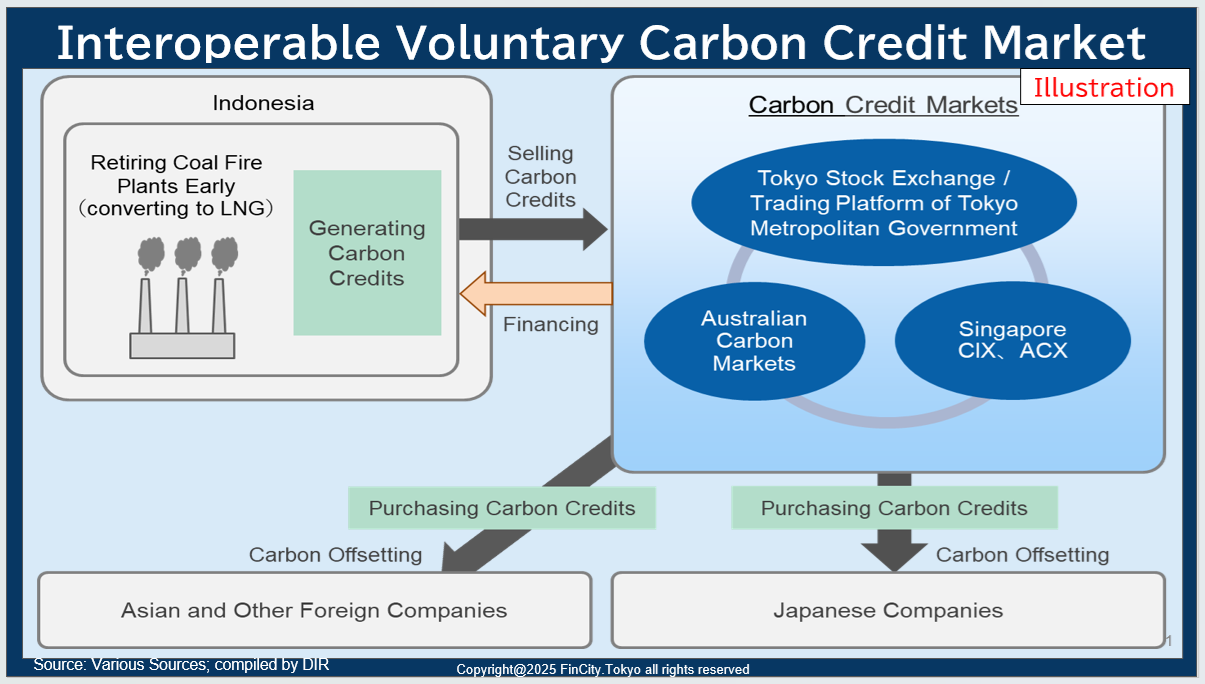

• We will support efforts to establish an “interoperable voluntary carbon credit market” in the Asia-Pacific. Chart 2 shows how this would work. An Indonesian electric power company reduces carbon emissions by retiring a coal-fired power plant, converts it into a cleaner LNG-burning plant, and sells part of the reduced emissions as carbon credits to domestic as well as overseas markets like Tokyo and Singapore to recover the cost for the new plant. Businesses in the region can purchase carbon credits to help offset their own emissions. In this way, we can accelerate regional decarbonization.

This initiative has advanced to the point where economies in the region are focused on establishing common standards and practices for integrity and interoperability of carbon credit trading. Likewise, exchange linkage may be expanded beyond the test-proven cross -exchange trade between ACX Singapore and IDX Carbon of Indonesia. Tokyo aims to play an integral role in this initiative.

Chart 2:

• Finally, we will enhance collaboration with overseas partners. For example, in December last year, the City of London launched the Transition Finance Council, and in July this year, we co-hosted a forum in London with this Council on transition finance. Going forward, through Japan-led frameworks such as the Asia GX Consortium and the Asia Zero Emission Community, we will continue to highlight Tokyo’s advantages globally.

Do you have a final message for audiences overseas considering opportunities in Tokyo?

The successful reforms over the past few years have produced a fast-growing and dynamic finance ecosystem. Tokyo today offers easy access to English-language business support free-of-charge, a huge talent pool, world-leading infrastructure, and globally renowned quality of life. We look forward to welcoming you and assisting you with capturing opportunities here.